J.P. Morgan Asset Management - ESG Explained

In just a few years, ESG investing has grown in prominence. How can investors capitalize on this trend? What is ESG? The use of environmental, social and governance factors to inform investment decisions.

WHAT'S ESG?

The use of environmental, social and governance factors to inform investment decisions.

In just a few years, ESG investing has grown in prominence. From consumers to policymakers, many economic actors are backing sustainability—creating a powerful portfolio opportunity.

| 69% of retail investors are interested in ESG. Yet only 10% actually invest in products that incorporate ESG factors. Source: CFA Institute - June 18, 2020 |

How can investors capitalize on this trend? To properly invest in ESG, it's important to first fully understand it. Here are seven essential reasons that help investors understand the growing importance of ESG investing.

THE 7 ESSENTIALS

1. ESG considerations are effecting consumer preferences and public attitudes.

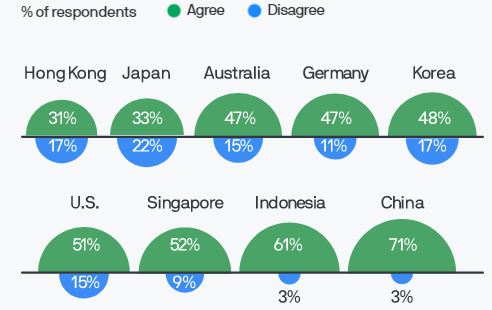

“I buy from companies that are conscious of protecting the environment.”

Source: J.P. Morgan Asset Management; PwC. PwC’s June 2021 Global consumer insights pulse survey was conducted in March 2021. It polled 8,681 consumers across 22 territories. The respondents were at least 18 years old and were required to have shopped online at least once in the previous year. Data reflect most recently available as of June 30, 2021.

Why it matters

Consumers are making decisions with sustainability in mind, and they’re voting with their wallets. This change has ripple effects, and is expanding from the individual to the macro level.

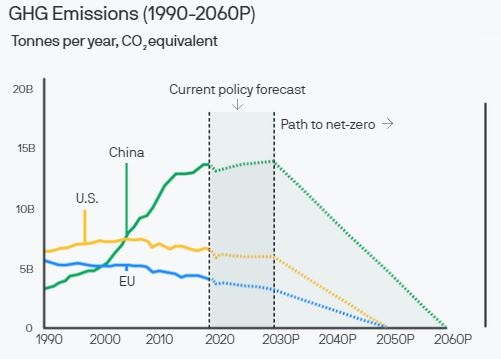

2. Policymakers are setting environmental and social goals.

Governments of the world’s top greenhouse gas (GHG) emitters are working towards a net zero future, in which emissions are reduced or offset.

Source: J.P. Morgan Asset Management; Climate Action Tracker. Current policy forecast is the post-Covid forecast provided by Climate Action Tracker. Data reflect most recently available as of June 30, 2021.

Why it matters

Altogether, around 60 countries and regions— representing over half of global GHG emissions—have set ambitious net zero emissions targets for the coming decades.

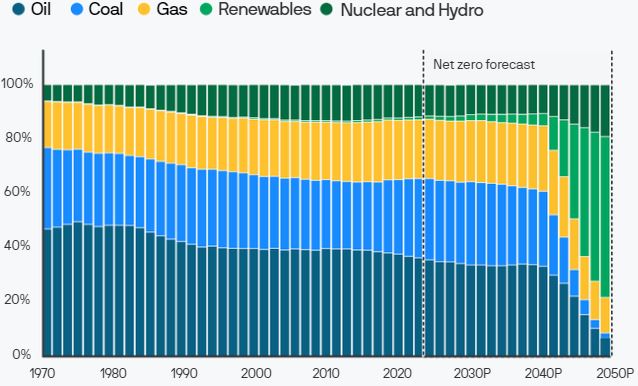

3. For some, the shift to sustainability may be headwind.

To achieve net zero emissions by 2050, traditional energy needs to account for a much smaller proportion of the global energy mix

Global Energy Mix % of primary energy consumption

Source: J.P. Morgan Asset Management, BP Energy Outlook 2020. Forecast is based on BP ’s scenario for global net zero emissions by 2050. Data reflect most recently available as of June 30, 2021.

Why it matters

The shift to renewable energy may pose a challenge for industries reliant on fossil fuels. Fortunately, it's not too late for companies to transition.

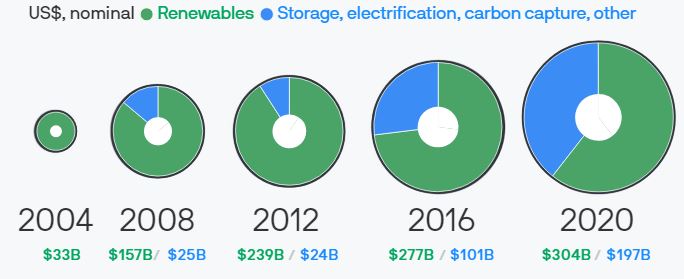

4. For some, the shift to sustainability may be a headwind.

ESG creates significant opportunities for those at the forefront of change. Billions of dollars are flowing into the energy transition.

Global investment in Energy Transition

Source: Bloomberg NEF, BP Statistical, Eurostat, Lazard, METI, J.P. Morgan Asset Management. Storage, electrification, other includes hydrogen, carbon capture and storage, energy storage, electrified transport and electrified heat. Data are as of June 30, 2021.

Why it matters

Sustainability is propelling investment opportunities with return potential.

5. ESG covers more than climate - the focus on social and governance is growing too.

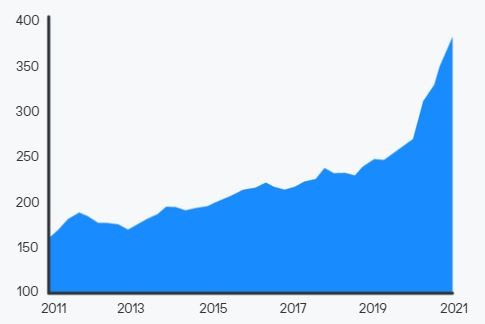

Corporate Mentions of Diversity/Inclusion in Earnings Calls

Number of mentions for MSCI ACWI companies, four-quarter moving average

Source: J.P. Morgan Asset Management, MSCI. Data as of June 30, 2021.

Why it matters

The recent jump in corporate mentions of social issues signals rising interest and regulatory pressure.

6. ESG is affecting the investment landscape.

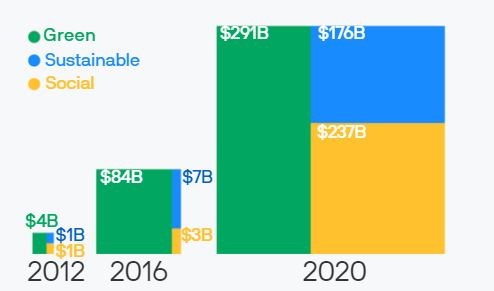

The demand for sustainable fixed income strategies is also growing rapidly, with sustainable bond issuance doubling in 2020.

Global Sustainable, Social and Green Bond Issuance

Source: J.P. Morgan Asset Management; Climate Bonds Initiative. Data as of June 30, 2021.

Why it matters

Sustainable investing is not limited to equities— environmental and social projects have increasing access to financing.

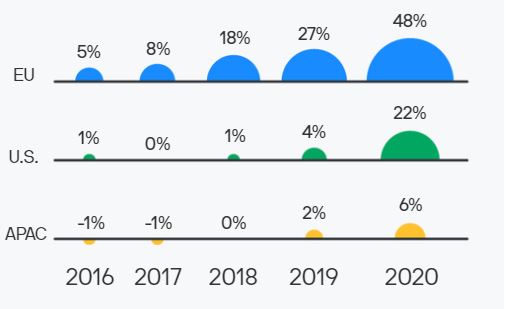

7. ESG is changing the nature of investment flows.

Share of Total Net Flows into Sustainable Strategies

Source: J.P. Morgan Asset Management, Morningstar. Data as of June 30, 2021.

Why it matters

We expect the demand for sustainable funds will continue to increase.

| Incorporating ESG criteria into investing is as much about doing well, as it is about doing good. |

Important Information

Forecasts, projections and other forward-looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecasts, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated. The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.