Morningstar - Fundamentals of ESG Materiality

An Overview for Investors

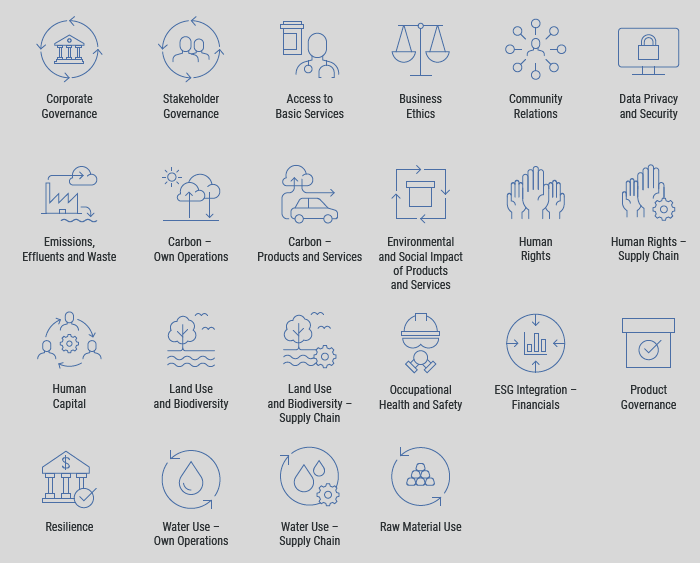

Materiality of ESG factors

In a rapidly changing world, environmental, social, and governance (ESG) factors are no longer just buzzwords — they represent real-world risks that have the potential to profoundly impact businesses for better or for worse.

The impacts of climate change are intensifying, cyber threats loom large, and global supply chains have become more complex and interconnected, all while regulators seek to protect investors from greenwashing risks. Understanding and integrating ESG risk into your investment process could present both material risks and opportunities.

The latest thought leadership piece from Morningstar Sustainalytics delves into the materiality of ESG factors, analyzing their influence on business viability and investment strategies.

Discover:

- The Purpose of This Overview; The current state of the ESG landscape

- What Makes an ESG Issue Material?

- Approaches to integrate ESG factors

- Three Key Reasons Why Investors Are Evaluating ESG Risk

- Understanding How Mismanagement of MEIs Affects Business

- Using Material ESG Data to Support Your Investment Approach.

- The different approaches used to incorporate sustainable preferences

- ESG Risk is Enterprise Risk. How regulations are aiding decision-making

Don't miss this essential guide to navigating the ESG landscape. Download your copy 📄

________________________________________________________________________________________

Morningstar’s Editorial Policies

Read Morningstar's editorial policy to learn more about their process.